OUT OF POCKET EXPENSES MEDICARE FULL

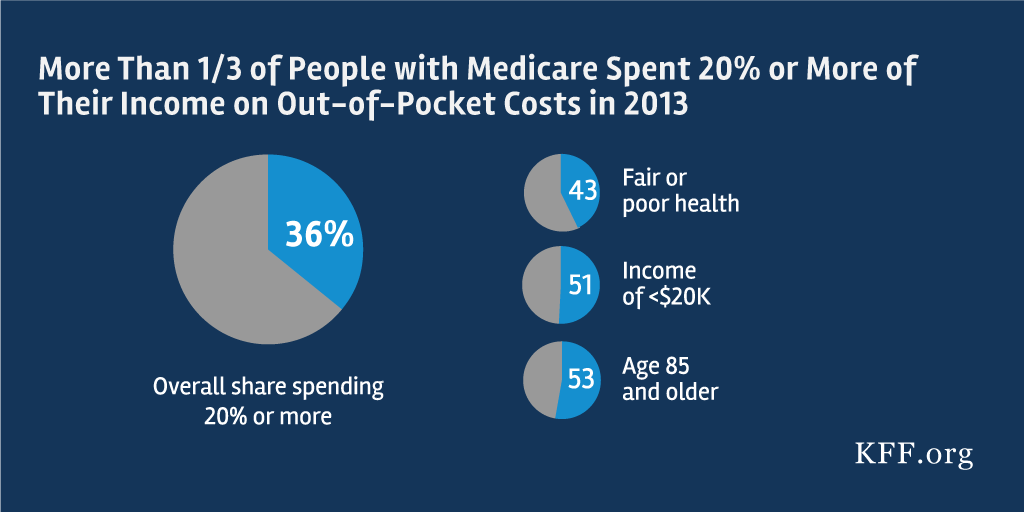

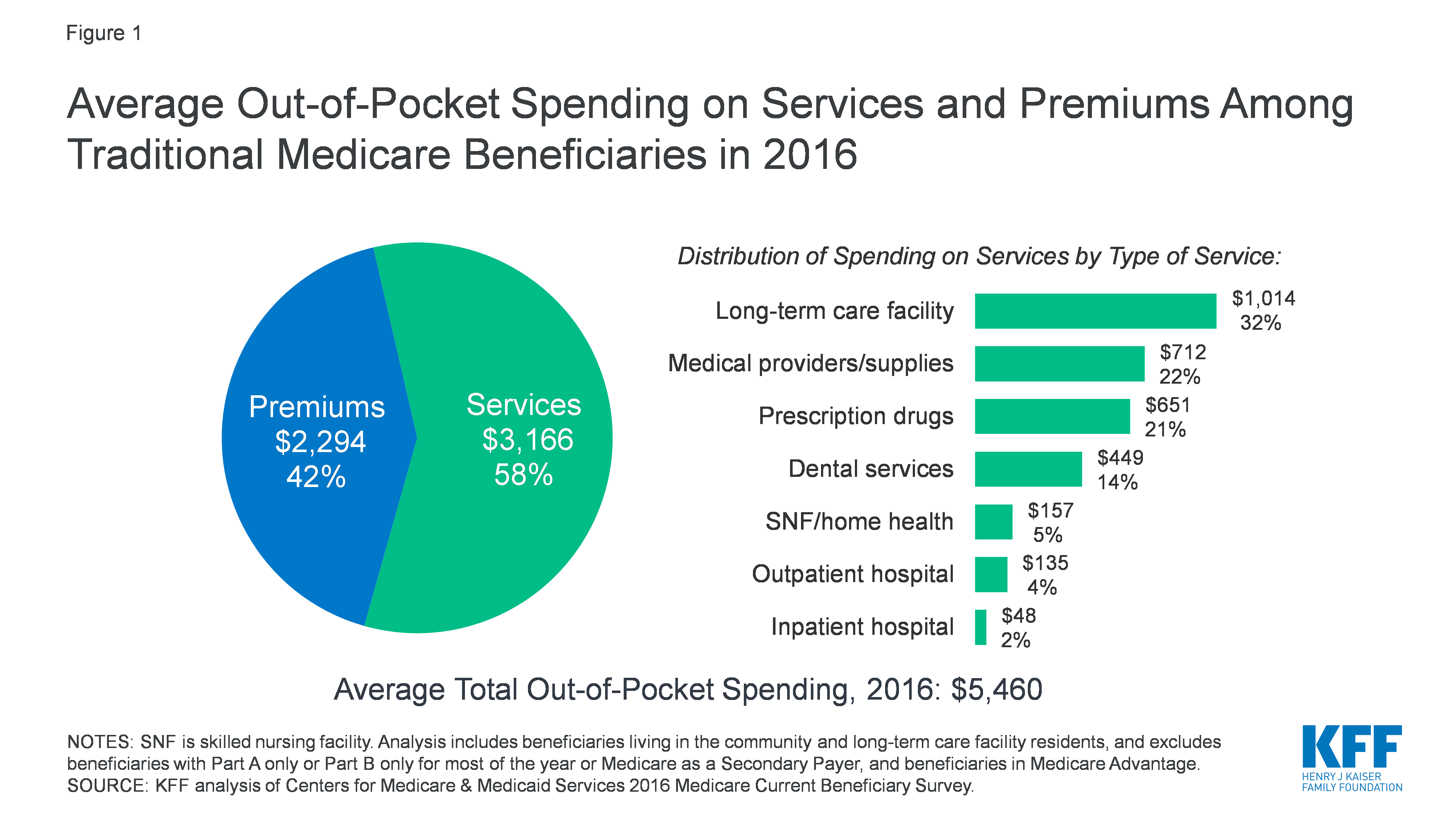

The health professional bills Medicare and accepts the Medicare benefit as full payment for the service. If you are bulk billed for a medical service you will pay no out of pocket costs. at a private hospital accident and emergency department.outside a hospital, for example for appointments or diagnostic tests.You might also have to pay out of pocket costs for medical services: hospital charges like accommodation and theatre fees.However, you may have to pay out of pocket costs if you have medical treatment as a private patient in a private or public hospital. If you have treatment as a public patient at a public hospital you do not pay anything for your medical treatments.Ĭosts for many private treatments are also fully covered by Medicare and private health insurers. That limit can be $7,550.On this page What you might pay out of pocket costs for Medicare Advantage plans offer lower premiums and have a maximum out-of-pocket limit.For example, pay the premium for Plan G and, when using healthcare providers who’ll see Medicare patients, the maximum out-of-pocket costs for the year will be the Part B deductible. Adding a Medicare supplement plan to Part A and Part B provides protection from unlimited costs.But get sick and, because there is no cap, the bills may never stop. Enrolling in Medicare Part A and Part B, without additional coverage, is not a wise decision.Of those plans, 32 plans charge 20% for chemotherapy treatments four charge 10-20% and the remaining two – $0 or 20%.

OUT OF POCKET EXPENSES MEDICARE ZIP

In Sandra’s Florida zip code, there are 38 zero-premium plans. This is common with many Advantage plans. She would pay 20% of every chemotherapy treatment. However, one cost likely would shock Sandra.

The diagnostic tests and procedures ranged from no charge up to $225 and there was a $200 per-day copayment for the first seven days in the hospital. The copayment for her primary physician would be $10 and for her specialist, $40. One zero-premium plan had a $5,000 out-of-pocket maximum limit. Here’s how Sandra would have fared with a Medicare Advantage plan. In 2019, the average out-of-pocket limit was about $5,000 for in-network services and almost $8,900 for out-of-network. Each plan determines its maximum out-of-pocket limit and can opt to offer a lower limit.Once the limit is reached, the plan covers any costs for the remainder of the year.The maximum limits will increase to $7,550 for in-network and $11,300 for in- and out-of-network combined. However, that changed as of January 1, 2021. Since 2011, the limit has been $6,700 for in-network services and $10,000 for in- and out-of-network combined.Services not usually covered by Medicare, such as hearing, vision, and the new “daily maintenance benefits”also are not counted in the limit.This limit excludes monthly premiums and prescription medications.Only Medicare-covered services count toward the out-of-pocket limit.Plan members then face deductibles, copayments or coinsurance for healthcare services. Plans can have no or very low premiums.

Here are some things to know about Medicare Advantage and the maximum limit. That’s because these plans must establish a maximum out-of-pocket limit on the cost sharing that plan members face. The commercials say that Medicare Advantage plans cap your costs.

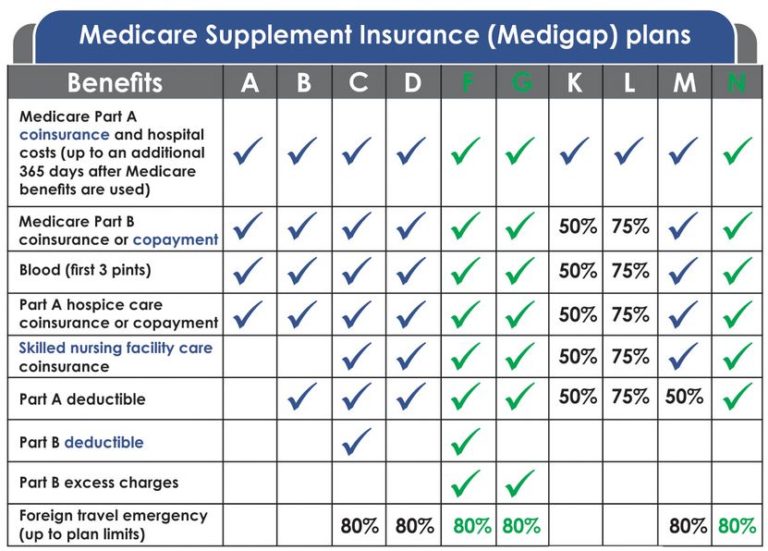

She would not face unlimited out-of-pocket costs. After paying the Part B deductible, the plan would cover the 20% coinsurance for outpatient services, including the chemotherapy treatments. Sandra would have had coverage for the Part A hospitalization deductible. What if Sandra had a Medicare supplement Plan G, along with Part A and Part B? This plan covers all Medicare costs, except the Part B deductible. (Massachusetts, Minnesota and Wisconsin have their own method of standardization.) A specific package of benefits comes with specified out-of-pocket costs. In 47 states, Medicare supplement plans are standardized by letter. These plans, sold by private insurance companies, help to cover the costs that Part A and Part B do not. Medicare supplement insurance, also called a Medigap policy, can ease the concern about unlimited out-of-pocket costs. She was surprised to learn she would be responsible for 20% of every chemotherapy or radiation treatment, with no cap.īut there is another chapter to the Original Medicare story. After discharge, she started her treatments. Then, she was hospitalized for surgery, with that deductible. Between the physician appointments and diagnostic studies, she quickly met the Part B deductible. She was very healthy and didn’t want to pay for more coverage she wouldn’t need. For example: Sandra enrolled in Part A and Part B only.

0 kommentar(er)

0 kommentar(er)